7 million Kenyans push Fuliza loans to Ksh.503 billion

Audio By Vocalize

One million more Kenyans took Fuliza loans in

the last 12 months, pushing disbursements from the overdraft facility to

Ksh.502.6 billion from Ksh.351.2 billion last year.

The 43.1 per cent growth in disbursements on

the service represents loans taken between April 1, 2021 and March 31, 2022.

Customers on the Fuliza service grew by 16.4

per cent year over year to 6.9 million borrowers from a previous 5.9 million borrowers

on the platform in March 2021.

On its part, Safaricom earned Ksh.5.9 billion

in revenues from the Fuliza disbursements, representing a 31 per cent growth in

disbursements from the service from Ksh.4.5 billion previously.

On the flipside, KCB M-Pesa and M-Shwari

registered a slump in loans disbursed in the same period with the value of

loans taken on the platform tanking by 9.4 and 8.9 per cent respectively.

KCB M-Pesa facilitated loans worth Ksh.46.3

billion in the period down from Ksh.51.1 billion last year while disbursements

on M-Shwari fell from Ksh.94.5 billion to Ksh.86.1 billion.

The discrepancy in disbursements between

Fuliza and the pair of KCB M-Psa and M-Shwari likely points to Kenyans

preference for short time loans over long term loans, according to M-Pesa

Africa Managing Director Sitoyo Lopokoiyit.

The average loan size taken on Fuliza stood

at Ksh.345.20 in the period but was down from Ksh.446.20 last year.

Comparatively however, KCB M-Pesa and M-Shwari

have larger average loan ticket sizes at Ksh.6,874 and Ksh.6,172 respectively.

During the year, Fuliza users made repayments

of Ksh.510.3 billion on the platform, pushing the repayment/disbursal rate to

101.5 per cent from a lower 98.4 per cent in March 2021.

This implies that nearly all Kenyans taking

loans through Fuliza are fully meeting due payments.

In contrast, the repayments versus disbursal

rate for KCB M-Pesa and M-Shwari was lower at 97 and 63.2 per cent.

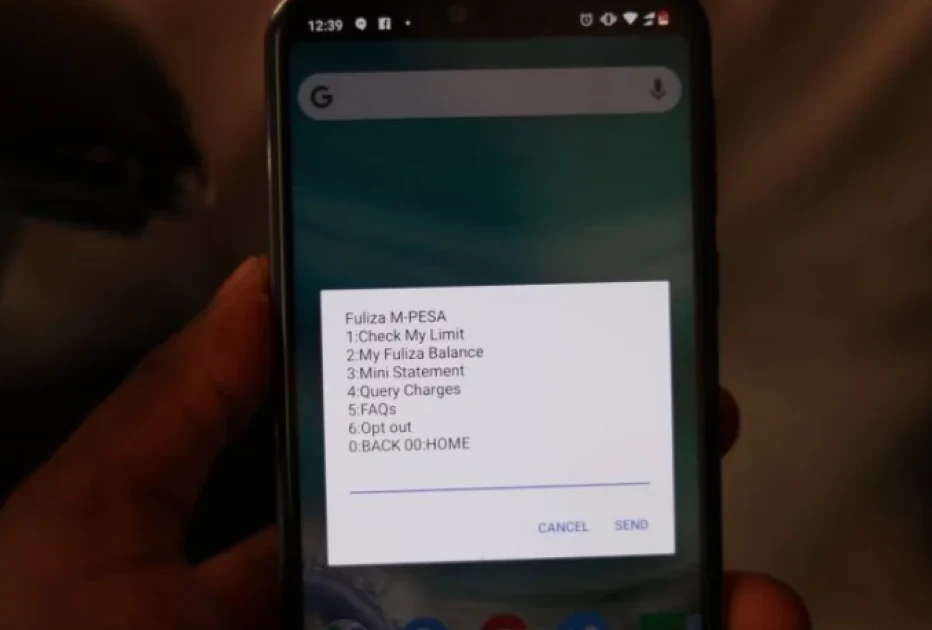

Fuliza, a partnership between Safaricom, KCB and

NCBA is an overdraft facility allowing customers to complete M-Pesa

transactions despite insufficient funds in M-Pesa wallets.

The platform charges a one per cent access

fee and a maintenance fee on the outstanding balance which ranges from Ksh.6

and Ksh.36 a day depending on the value of the overdraft taken.

Borrowings under Fuliza in the period

represented overdrafts of about Ksh.1.4 billion a day.

Leave a Comment