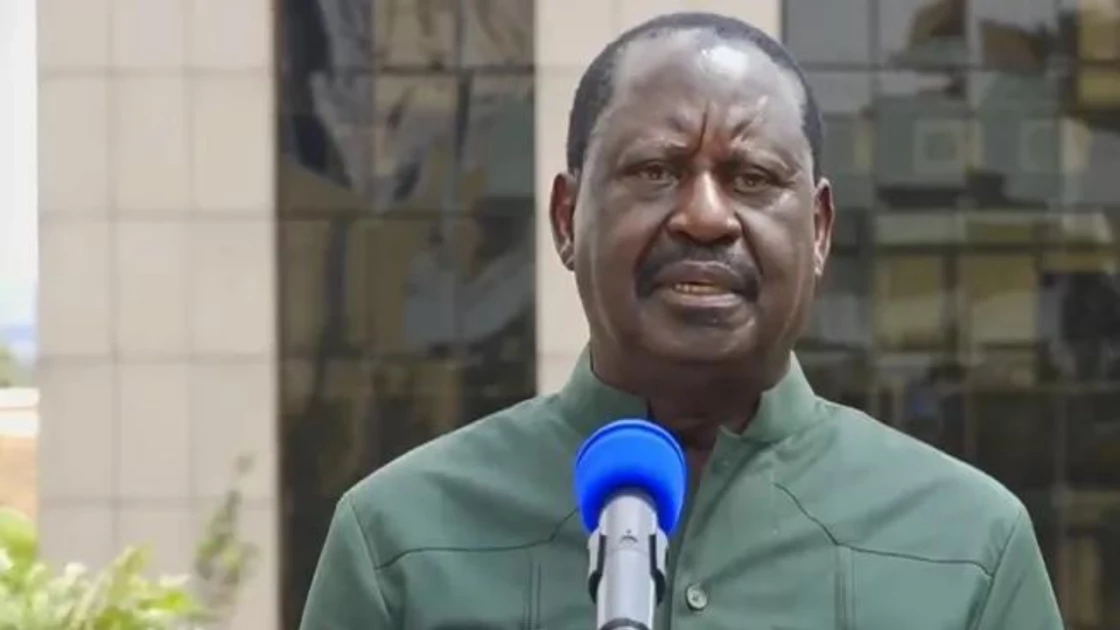

'Kenyans are taxed to the bone,' Raila says as Azimio opposes Finance Bill 2023

Azimio la Umoja One Kenya Alliance party leader Raila Odinga

Audio By Vocalize

Calling it a "promissory note to strangle and suffocate the hustlers from whose necks Ruto promised to remove the rope", he said he would do everything possible to prevent the Bill from being passed in the National Assembly.

The Azimio leader argued that Kenyans are being taxed to the bone and that Kenya Kwanza'a internal weaknesses are to blame.

"We will be instructing our members to pause this Bill's proposals," Raila said during a press conference on Monday.

"In the event that Kenya Kwanza uses its hired majority and passes the Bill as it is, we want the people of Kenya to understand that it will be a Kenya Kwanza Bill."

According to Raila, there is mischief written all over the Bill which he says raising the Turnover Tax to 3% will affect small and medium-sized businesses by taxing their gross sales regardless of whether they make profits or not.

Instead, the Azimio leader proposed that the tax remains at 1%, applicable to gross sales of Ksh.1 million or more.

'These businesses are already being taxed by County Governments," he added.

The opposition boss said the proposed income tax adjustment will further burden Kenyans, the majority of whom have not received a pay increase in the last five years.

He contended that direct taxation would reduce disposable income in the country and have an impact on all sectors of the economy.

"As Kenya Kwanza reduces the local disposable income, it is inadvertently reducing the demand for local goods and services," said Raila. "It leads to more unemployment and more desperation."

At the same time, he took aim at the proposed Housing Fund, claiming that the proposed 3 per cent salary deduction to fund affordable housing is "irrational" given that most employees are already dealing with reduced income due to high living costs.

"We find it curious that while not everyone qualifies for the proposed affordable housing regime, everyone is expected to pay. This is illegal borrowing," Raila added.

He also questioned the logic behind the proposal for a Tax Appeals Tribunal which would require individuals or businesses to deposit 20% of the disputed amount with the KRA before the case could be heard.

"This is another aspect of illegal borrowing by the regime. It is open to abuse by rogue KRA agents. It will affect the cash flow of companies. We oppose it," he said.

During his speech, Raila also criticised the proposal for increased VAT payments as well as the increased excise duty on imported cement.

Also making it to the list of issues highlighted by Azimio is the proposed taxation on beauty products.

According to Raila, the proposed 316 per cent increase in wigs, false beards, eyelashes, human hair, and artificial nails, among other items, will affect youth and women currently employed in the industry.

Raila also accused the government of suffocating innovation by proposing a turnover tax on the monetization of digital content.

"From paying zero tax currently, a creative youth who creates a digital platform or content will be required to pay 15 per cent tax. As a country, we will be killing innovation and leaving our youth with too few options, if any," he added.

Leave a Comment