Mombasa Port: How Kenya’s auditor-general misread China’s Standard Gauge Railway contracts

A general view shows the Standard Gauge Railway train constructed by the Chinese Communications Construction Company and financed by Chinese government. Simon Maina/AFP

Audio By Vocalize

In

December 2018, a leaked letter from the Kenyan

auditor-general’s office sparked a rumour that Kenya had staked its bustling

Mombasa Port as collateral for the Chinese-financed

Standard Gauge Railway. Our new research shows why the collateral

rumour is wrong.

The

former auditor-general, Edward Ouko, was completing the 2017/18 audit of the national ports

authority. He warned that the port authority’s assets – of which Mombasa Port is

the most valuable – risked being taken over by China Eximbank if Kenya

defaulted on the US$3.6 billion railway loans.

The

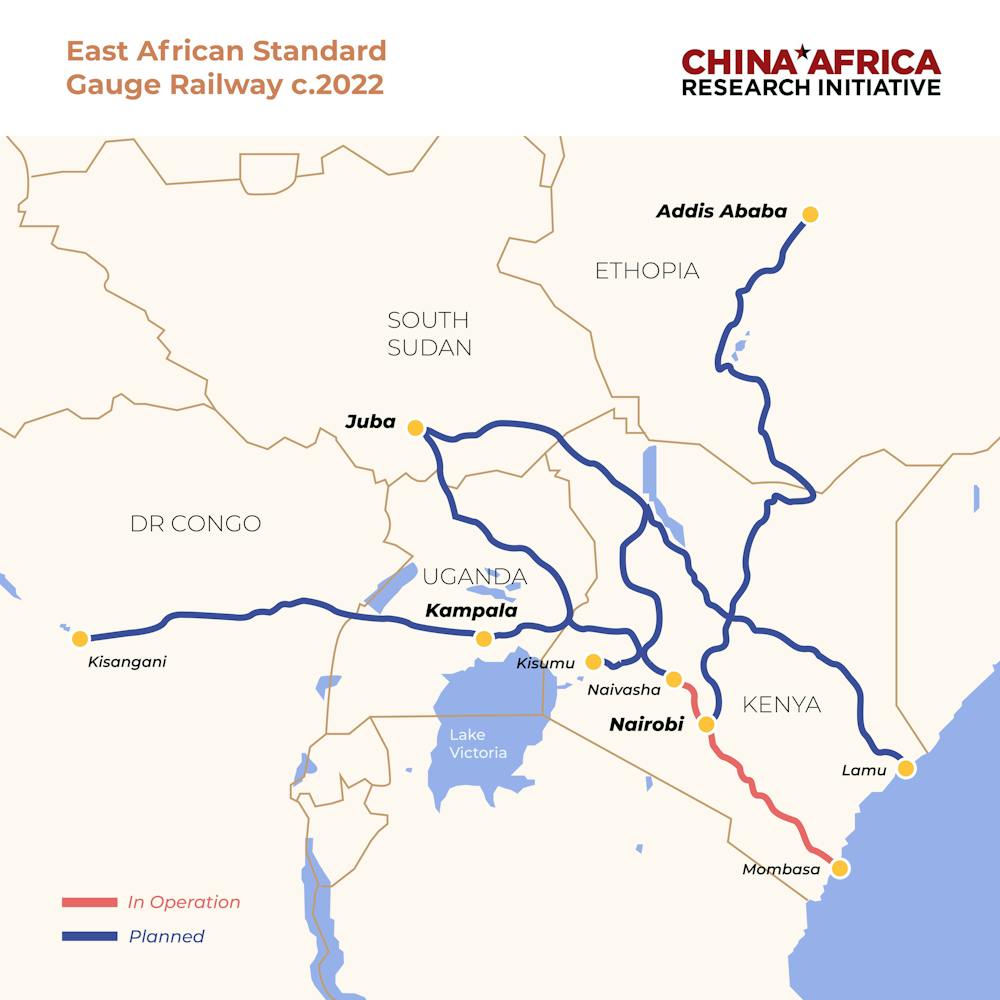

profitable Mombasa Port is East Africa’s main international trade gateway.

Launched in 2017, the railway was intended to seamlessly link the port to

Kenya’s capital, Nairobi, and landlocked countries beyond.

The

Kenyan fears mirrored another tale widely circulated earlier in 2018. In that

story, China was said to have “seized” Hambantota Port in Sri Lanka when the

island nation had trouble repaying Chinese loans. This “debt trap diplomacy”

allegation was later shown to be a myth, but not before it sparked fears

about other large Chinese projects.

The

Chinese and Kenyan governments both denied that Mombasa Port was collateral but

offered no explanation. Perplexed by the leaked letter, our team of scholars and

practitioners of international commercial law and project finance spent months

collecting primary documents and mapping the project’s contractual structure.

To

our surprise, we found that the collateral rumour stemmed from a seemingly tiny

but critical misreading by the auditor-general. The chief auditor mistakenly

labelled the ports authority as a borrower, responsible for repaying the

Chinese railway loans. He charged that by waiving sovereign immunity, Kenya’s

government had “expressly guaranteed” that the ports

authority’s assets could be used to repay the Chinese loan. The auditor-general

was mistaken in both charges.

For

the auditor-general, and many others, the debate over the railway and Mombasa

Port was complicated by technical terms and practices. These are used routinely

in the law and business of international project finance but are unfamiliar

outside this arena.

Although

some public education would have been necessary, releasing the contracts (which

Kenya’s High Court ordered the government to do just last week) might have prevented the

auditor-general’s mistake, and would have allowed debate on the facts, rather

than rumours.

Mapping

the project

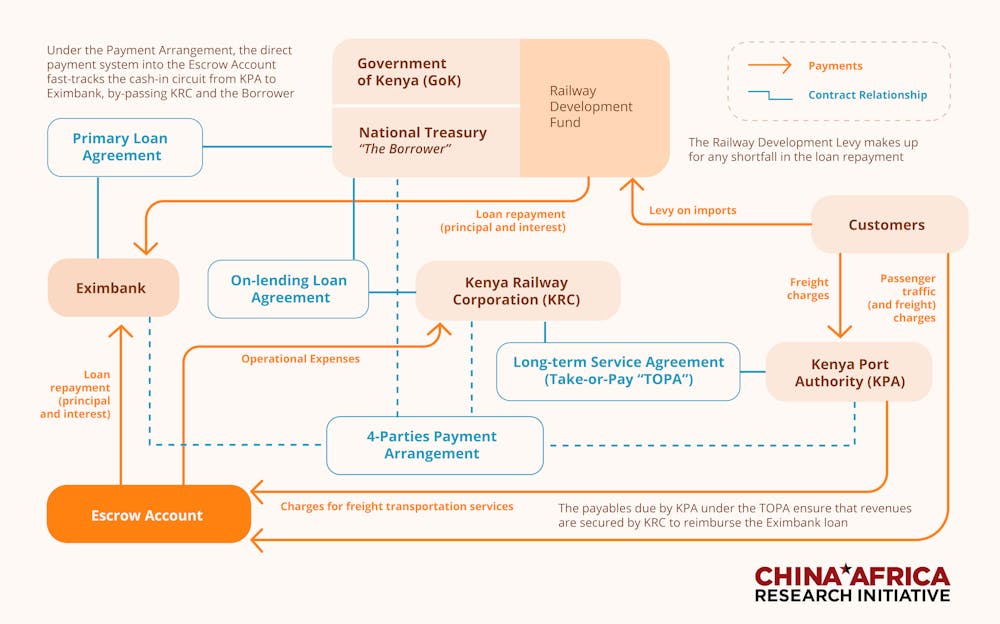

The four key stakeholders in the financing of the Standard Gauge Railway were Kenya’s National Treasury (the borrower), the Kenya Railway Corporation (the project company), the Kenya Ports Authority and China Eximbank (the lender). The figure below maps the complicated contractual and payment arrangements.

Kenya’s

treasury explained the railway’s financing arrangements and credit enhancements

in some detail in a 2013 briefing to Kenya’s parliament. The

government had arranged several credit enhancements to boost the financial

attractiveness of the costly project, rendering it “bankable”.

Among

these was a “take or pay” agreement signed between the national railway

corporation and the ports authority. Under this 15 year agreement, the ports

authority undertook to ship (or “take”) a minimum amount of cargo on the new

railway every year. If cargo shipments dropped below the agreed annual level,

Kenya Ports Authority would draw on its own revenues to cover (“pay”) the

shortfall.

The

ports authority is thus the Standard Gauge Railway’s major client, not its

collateral. The treasury also pledged that the railway development levy, a 1.5%

tax on Kenya’s imports, would support the project.

The

mistakes

One

of our most important findings is that the government’s chief auditor was

mistaken to call Kenya Ports Authority a borrower. If the ports authority was a

borrower, it would mean that it had co-signed the Chinese loans and was equally

responsible for repayment. But the ports authority is not in any sense a

borrower.

Clause

17.5 of the four party agreement quoted by the auditor-general in its report spelled out the

relationships: “Each of the Borrower, Kenya Rail Company and Kenya Port

Authority agrees…”

Our legal expert immediately noted that this refers to three entities: Kenya’s treasury (the borrower), the rail company and the port authority.

Yet

this distinction was missed by the auditor-general, who wrongly paraphrased the

clause as referring to two entities: “each of the borrowers, in this case Kenya

Railways Corporation and Kenya Ports Authority…”

The

auditor-general then pointed to Clause 17.5 to say that the

ports authority was a borrower and therefore its assets were at risk. The

auditor accused the ports authority of failing to disclose this during the

audit. The auditor-general was operating from incorrect assumptions that

influenced its opinion on the ports authority’s responsibilities.

What

does the waiver of sovereign immunity mean?

The

Treasury, Kenya Ports Authority and Kenya Railways Corporation all signed

“waivers of sovereign immunity”. This is because all three were parties to

various contracts in the overall package. Under international law, sovereign

states and entities they control have sovereign immunity. This means they are

generally immune from lawsuits and cannot be compelled to appear before a

foreign court or arbitration venue, or to enforce a judgement rendered outside

their borders. Yet few international banks will offer a loan if there is no

possibility of arbitration should a dispute occur and no legal path to recover

their money should the borrower default.

A

published cache of loan contracts signed by Cameroon

with banks and export credit agencies from Austria, India, Germany, Spain,

Turkey, and the UK shows that all required these clauses. As one American

lawyer noted,

leaving out a sovereign immunity waiver in an

international commercial loan contract would be professional malpractice.

However,

there is quite a large gulf between a general sovereign immunity waiver and

specifying a particular asset like a port as collateral.

Our

findings clarify similar rumours that borrowing governments have pledged

strategic assets like land or ports in exchange for Chinese finance. These

involve Zambia (Kenneth Kaunda Airport), Uganda (Entebbe Airport) and Montenegro (Port of Bar).

The debt trap diplomacy fear that borrowers’ strategic assets are directly (and deliberately) at risk from Chinese banks continues to fail the test of evidence.

[The

writer Deborah Brautigam, is a Bernard L. Schwartz

Professor of International Political Economy, Johns Hopkins University.]

Leave a Comment